If you’re searching for financial freedom, try creating a budget. Budgeting can help you reach your goal of financial independence. The key to budgeting is to be realistic. Check out these budgeting tips on how to budget your money and hit your financial goals once and for all.

Budgeting 101: How to Budget Your Money

1. To begin budgeting for financial success, start simple. Write down your total income for the month and note your total take-home pay, after taxes.

2. Then, list all your expenses. Make sure you’re keeping track of your monthly spending regarding the following:

- Rent

- Utilities

- Car payment

- Gas

- Food and groceries

- Household expenses

- Personal items

- Entertainment

- Additional monthly expenses

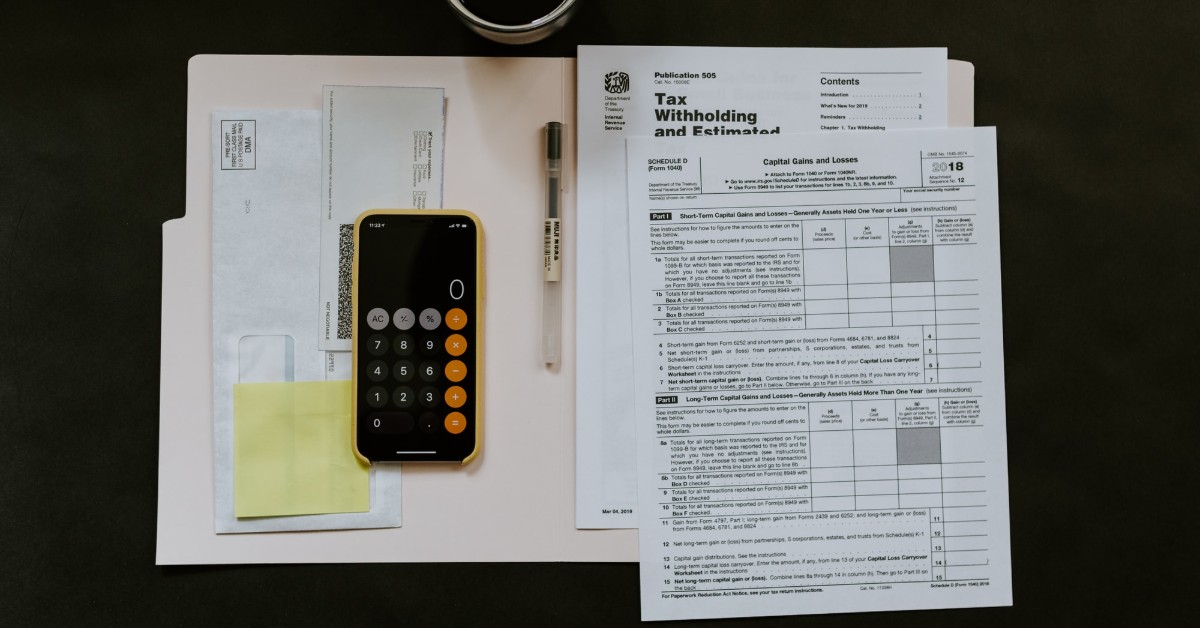

3. Track your progress and record all your spending. The more accurate you are in tracking all of your expenses, the more accurate your budget will be. You can use a pen and paper, budgeting tools, the notes application on your phone, or anything that will help you record daily spending.

Set Your Financial Goals

In order to determine savings and pay off your debts, you need to set realistic goals when budgeting for success. Start by subtracting your monthly expenses from your monthly income. If you’re making more money than you’re spending, you’re on the right track. This “leftover” money can be used for savings or for paying off debts and money loans.

Most people begin budgeting because they want to meet a long-term financial goal, such as buying a house, getting a new car, building an emergency fund, or saving for their children, among countless other things. Set these goals and figure out how much you’ll need to save in order to attain this goal.

Adjust Your Habits and Cut Your Spending

Now that you’re tracking your spending, identify which expenses you can cut back on. If you have unnecessary subscription services, or if you spend money on personal grooming every two weeks, look into lowering these bills. Cancel your recurring subscriptions or get a haircut less often. Skip movie night or schedule date night for once a month, rather than once a week. Make your coffee at home and bring your lunch to work. Once you evaluate your spending based on needs, you’ll find that these small savings can add up to a lot of money.

Revisit Your Budget as Often as Necessary

A budget is a plan set in place to reflect your lifestyle and align with your financial goals. Anyone and everyone can benefit from taking a proactive approach to control their finances and move with the ebbs and flows of money. Review your budget often, every few months or so, and adjust it as needed. Allow for your budget to expand and change just as your life does.

Blue Trust Loans provides an alternative to payday loans. Like most payday loans, installment loans have a quick and easy application process that can be completed online and verified over the phone. But unlike payday loans, loans from Blue Trust Loans are repaid in installments rather than in a single complete payment upon your next payroll check. Apply for cash online with Blue Trust Loans if you need emergency funding. You may be approved for an installment loan up to $3,000. Learn more about Blue Trust Loans’ alternative payday loan solutions here.

The content on this site is for informational purposes only and is not professional financial advice. Blue Trust Loans does not assume responsibility for information given. All information should be weighed against your own abilities and circumstances and applied accordingly. It is up to the reader to determine if this information is safe and suitable for their own situation.

Hummingbird Funds, LLC is a sovereign enterprise, an economic development arm and instrumentality of, and wholly-owned and controlled by, the Lac Courte Oreilles Band of Lake Superior Chippewa Indians (the “Tribe”), a federally-recognized sovereign American Indian Tribe. This means that the Hummingbird Funds’ installment loan products are provided by a sovereign government and the proceeds of our business fund governmental services for Tribe citizens. This also means that Hummingbird Funds is not subject to suit or service of process. Rather, Hummingbird Funds is regulated by the Tribe. If you do business with Hummingbird Funds, your potential forums for dispute resolution will be limited to those available under Tribal law and your loan agreement. As more specifically set forth in Hummingbird Funds’ contracts, these forums include informal, but affordable and efficient Tribal dispute resolution, or individual arbitration before a neutral arbitrator. Otherwise, Hummingbird Funds is not subject to suit or service of process. Nothing in this website is intended to waive or otherwise prejudice Hummingbird Funds’ entitlement to these protections. Neither Hummingbird Funds nor the Tribe has waived its sovereign immunity in connection with any claims relative to use of this mobile site. If you are not comfortable doing business with a sovereign instrumentality that cannot be sued in court, you should discontinue use of this website.